Executive Series

2 Day Applied Workshop - Solve Tough Problems

2 Day Applied Workshop - Solve Tough Problems

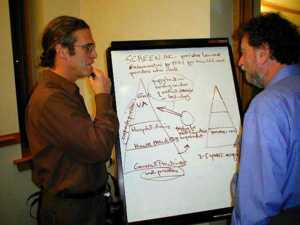

Day 1: Venture Investor's Assessment Process Model

Overall Goal: How investors assess (decode) a venture deal.

What you will Learn.

- How the VCs business model works

- How to strategically position your deal

- How to refine your business model diagram

- How to assess deals like a venture investor:

- Answer the top 3 killer investor questions

- Use the Venture Maturity Index Tool to uncover deal maturity

- Use demand modeling to drive investor returns

- Build a financially engineered business case & deal model

- Test your understanding of VC term sheet math

Day 2: Structured Funding Program

Overall Goal : Identify your solution path to funding.

- VenLogic Structured Funding Program Overview: 7 Step Process

- Equity Market Segmentation

- Equity Sales Channel Design

- Action Planning - mapping out your financing timeline

- How to budget for the Equity Marketing & Sales Process

- Why the Equity Marketing framework executes the funding process faster.

Download 2 Day Workshop Brochure

Live Venture Consulting.

For executives, private investors, and professionals.

Learn how to raise Venture Financing.

Ask the right questions to assess faster, better.

Apply the tools used by experienced venture professionals

Analyze and benchmark your company's funding probability

Spot the gaps in your path to funding

Design a roadmap to funding. Get real work done.

Executive Benefits

Applied, accelerated learning sessions

Learn more in a day, or spend months searching for answers.

Powerful lasting results. Lifetime value.

Streamline and cut months off your financing initiative

Learn to identify the "Funding Fast-Track"

Learn how the Silicon Valley Investors look at your deal.

Learn how to spot & fix equity marketing problems faster

Get "Real Tools" you can use and apply today

|

|

|

Sample Video Content:

Reviews:

Related Products

|

|

|